General Market Analysis – 20/02/26

US Markets Are Bracing for Inflation as Geopolitical Risks Escalate

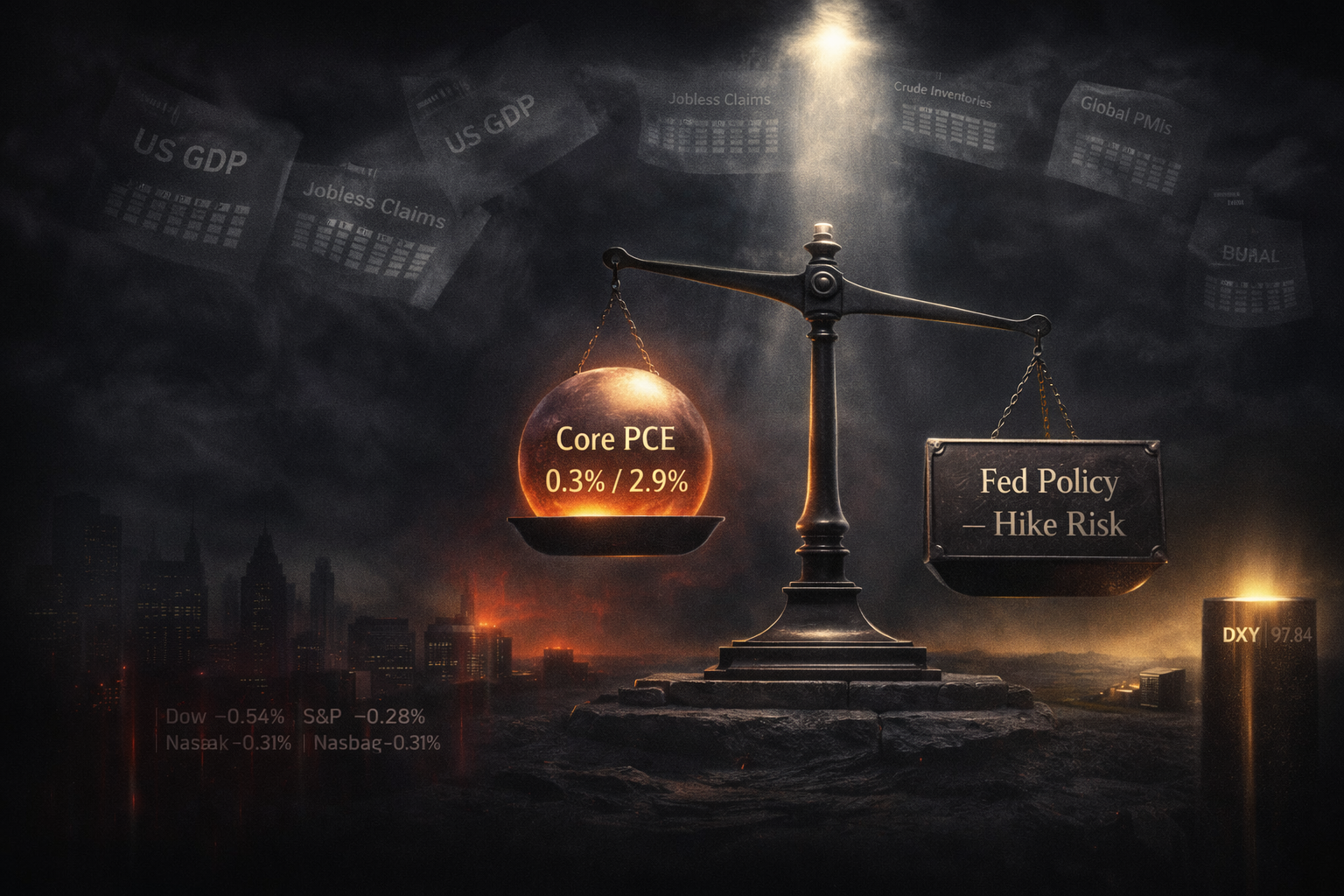

Equities are slipping, the Dollar is rebounding, and safe-haven demand is rising ahead of critical PCE data and amid mounting US–Iran tensions.

US Stocks Are Easing as Risk-Off Mood Takes Hold

US equities are finishing lower as investors are weighing a complex cocktail of sticky inflation signals, hawkish Federal Reserve rhetoric, and intensifying geopolitical risk emanating from the Middle East. With the Federal Reserve’s preferred inflation gauge — the Core PCE Price Index — due to print shortly, traders are keeping their powder dry and positioning defensively across risk assets.

The Dow Jones Industrial Average is sliding 0.54% to 49,395. The S&P 500 is losing 0.28% to settle at 6,861, while the Nasdaq Composite is retreating 0.31% to 22,682. Treasury yields are edging lower across the curve in a modest flight to safety, while the US Dollar Index is extending its rebound to 97.84 — its strongest level since early February — as the currency is benefiting from both the hawkish Fed narrative and safe-haven demand.

US Inflation Is Back in the Spotlight — and the Fed Is Watching Closely

Attention is turning squarely to today’s PCE inflation release. The Federal Reserve’s preferred measure of underlying price pressure is carrying extraordinary significance this week, coming hot on the heels of Wednesday’s FOMC minutes. Those minutes are revealing growing concern among policymakers over sticky inflation and are raising the prospect that the next policy adjustment could be a rate hike, rather than the two cuts that markets had been pricing in.

The consensus is calling for Core PCE to come in at 0.3% month-on-month and 2.9% year-on-year. A print above these levels is likely to trigger a sharp repricing of rate expectations, lending further support to the US Dollar and increasing downside pressure on equities, high-yield spreads, and emerging market assets.

Core PCE Price Index (YoY) — Forecast: 2.9%

GDP (QoQ, Q4 Final) — Forecast: 2.8%

Weekly Jobless Claims — Due 13:30 GMT

Crude Oil Inventories — Due 15:30 GMT

Middle East Tensions Are Driving Safe-Haven Demand for Gold and Oil

US–Iran tensions are escalating sharply and are emerging as one of the most significant market drivers heading into the weekend. The US is amassing military assets in the region, while Iran has reportedly disrupted shipping activity near the Strait of Hormuz — the world’s most critical oil chokepoint. Roughly 31% of all seaborne crude oil is transiting through this route, and any sustained disruption is capable of producing significant supply shocks in energy markets.

Oil prices are climbing on the back of these developments. Beyond the immediate energy market impact, the geopolitical uncertainty is also lifting the broader safe-haven trade: gold is receiving strong inflows, the Japanese Yen and Swiss Franc are finding support, and the US Dollar is benefiting from its reserve currency status.

Lunar New Year Thins Volumes; Japan CPI Supports the Yen

Asian trading is unfolding in thin conditions as Lunar New Year holidays are keeping regional participation subdued. China, Hong Kong, Taiwan, and South Korea are all observing holiday closures, materially reducing the depth and responsiveness of Asian markets.

Japan’s CPI is surprising to the upside this morning, reinforcing expectations that the Bank of Japan is continuing along its gradual policy normalisation path. The data is lending support to the Japanese Yen, which is benefiting from both the positive inflation surprise and the broader safe-haven bid flowing from geopolitical uncertainty.

Nikkei 225 futures are edging lower in line with US market cues and the weight of inflation concerns. The combination of a stronger Yen — which is historically a headwind for export-heavy Japanese equities — and the cautious global mood is keeping Japanese equity futures under pressure.

A Packed End to the Week Is Keeping Traders on Alert

| Release | Region | Forecast / Previous | Impact |

|---|---|---|---|

| Core PCE Price Index (MoM) | United States | 0.3% / 0.2% | HIGH |

| GDP (QoQ) Final — Q4 | United States | 2.8% / 4.4% | HIGH |

| Weekly Jobless Claims | United States | ~225K | MEDIUM |

| Crude Oil Inventories | United States | Variable | MEDIUM |

| Flash PMI | Global | ~50 borderline | MEDIUM |

How the World’s Leading Indices Are Trading Today

Nasdaq 100

The Nasdaq 100 is remaining under mild pressure, consolidating beneath recent highs as bullish momentum is cooling. The index is increasingly sensitive to the prospect of higher-for-longer Fed rates.

S&P 500

The S&P 500 is trading cautiously near record territory, displaying signs of consolidation. The combination of sticky inflation and geopolitical uncertainty is capping upside conviction.

FTSE 100

The FTSE 100 is finding support near short-term moving averages. The relative defensiveness of FTSE’s heavy energy weighting is offering some insulation from global risk-off.

Market Analysis — Your Questions Answered

© 2026 Capital Street FX. All Rights Reserved. | License number C112010690.