ADP Employment Miss Signals Cooling US Labor Market.

ADP Employment Miss Signals Cooling US Labor Market Ahead of Key Jobs Data

Market Overview: Private-Sector Hiring Slows Sharply

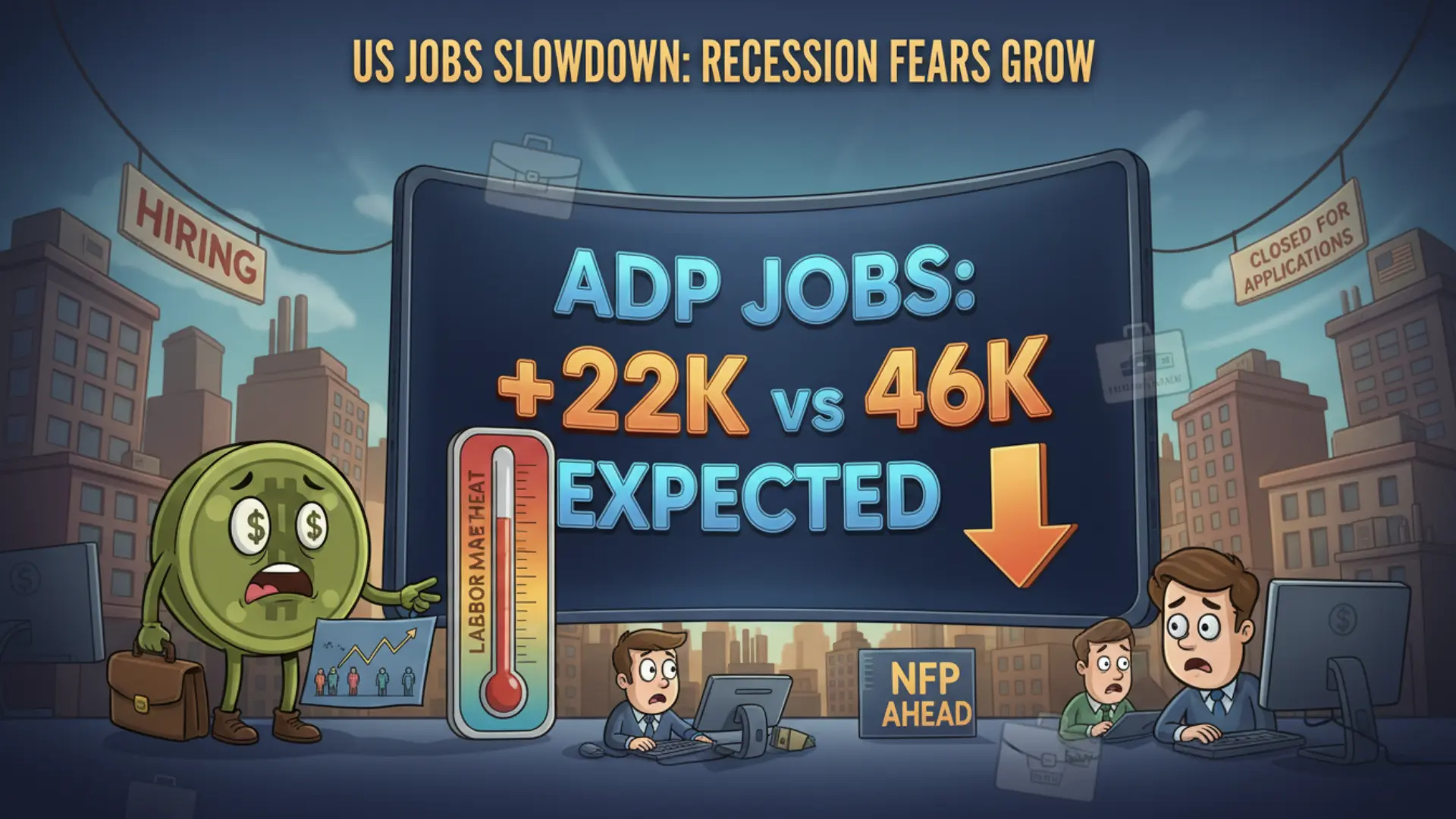

The latest ADP National Employment Report delivered an unwelcome surprise for markets, pointing to a sharper slowdown in US private-sector hiring. Job creation totaled 22,000 in the most recent month, falling well short of market expectations for 46,000 and easing notably from the previous month’s 37,000 increase.

The weaker-than-expected print immediately raised questions about the resilience of the US labor market, which has been a key pillar supporting economic growth and delaying expectations for aggressive Federal Reserve rate cuts.

Why the ADP Report Matters for Markets

Compiled using payroll data from roughly 400,000 US businesses, the ADP employment report is closely watched as an early indicator of labor market trends. Released two days ahead of the official government nonfarm payrolls report, it often shapes short-term market expectations, even though monthly readings can be volatile.

Historically, stronger ADP figures tend to support the US dollar by signaling robust labor demand and economic momentum. Conversely, weaker readings typically weigh on the dollar, as they suggest slowing growth and increase the likelihood of future policy easing. This month’s sizable miss versus expectations reinforces concerns that hiring momentum is losing steam.

Implications for the US Economy and Fed Policy

The slowdown in job creation adds to broader signs of cooling in the labor market. While employment growth remains positive, the declining pace suggests that higher interest rates may be having a delayed but growing impact on business hiring decisions. For policymakers, this trend complicates the outlook, particularly as inflation has eased but remains above the Federal Reserve’s target.

A softer labor market could strengthen the case for rate cuts later in the year, especially if upcoming data confirm a sustained slowdown in hiring and wage growth. However, Fed officials have repeatedly emphasized the need for clear and consistent evidence before adjusting policy, making the next set of employment data critical.

US Dollar Reaction: Sensitivity to Labor Data Increases

Currency markets tend to react swiftly to surprises in employment data, and the latest ADP report is no exception. A weaker labor print typically undermines confidence in the US dollar, as it challenges the narrative of economic outperformance and narrows interest rate differentials.

With investors already alert to shifting expectations around Fed rate cuts, disappointing labor data heightens the dollar’s sensitivity to upcoming releases. As a result, near-term price action is likely to remain volatile until greater clarity emerges from official government figures.

What Traders Are Watching Next

- The upcoming official Nonfarm Payrolls report for confirmation or contradiction of the ADP signal

- Wage growth and unemployment data for signs of broader labor market softening

- Federal Reserve commentary following the latest employment figures

- US Treasury yield movements in response to shifting rate expectations

- Risk sentiment across equity and currency markets

Outlook: Focus Shifts to Official Jobs Report

Looking ahead, attention now turns squarely to the official US nonfarm payrolls release. While the ADP report offers a valuable early snapshot, it does not always align perfectly with government data. A weak nonfarm payrolls number would reinforce concerns about labor market cooling and could accelerate expectations for Fed easing, while a stronger-than-expected outcome could ease immediate fears and stabilize market sentiment.

Until then, the latest ADP figures serve as a cautionary signal that the US labor market may be losing momentum after a prolonged period of strength.

Summary

The ADP Nonfarm Employment Change report came in well below expectations, signaling a slower pace of private-sector hiring and raising concerns about the strength of the US labor market. The decline from the prior month reinforces signs of cooling, increasing the importance of the upcoming official nonfarm payrolls report. With Fed policy expectations and US dollar sentiment closely tied to labor data, markets are likely to remain sensitive to further employment signals.

FAQs

What is the ADP National Employment Report?

The ADP report estimates monthly changes in US private-sector employment based on payroll data from hundreds of thousands of businesses.

Why did markets react to the weaker ADP reading?

The report missed expectations by a wide margin, suggesting slower job growth and raising concerns about economic momentum.

How reliable is ADP as a predictor of nonfarm payrolls?

ADP is a useful indicator but can be volatile and does not always align closely with the official government employment report.

What does slower job growth mean for Federal Reserve policy?

A cooling labor market may increase the likelihood of future rate cuts, especially if inflation continues to ease.

How does employment data affect the US dollar?

Stronger job growth typically supports the dollar, while weaker employment figures tend to pressure it by shifting rate expectations.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Economic data and market conditions can change rapidly, and past performance is not indicative of future results. Readers should conduct their own research or consult a qualified professional before making investment decisions.