UK Jobless Rate Rises to 5.2% as Wage Growth Slows.

UK Unemployment Rises to Highest Since 2021 as Wage Growth Slows, Boosting BoE Rate Cut Bets

Market Overview: Labour Market Softening Gains Momentum

The UK labour market showed further signs of cooling in the latest data release, with unemployment ticking higher and wage growth moderating more sharply than expected. The figures reinforce expectations that the Bank of England could move closer to additional interest rate cuts in the coming months.

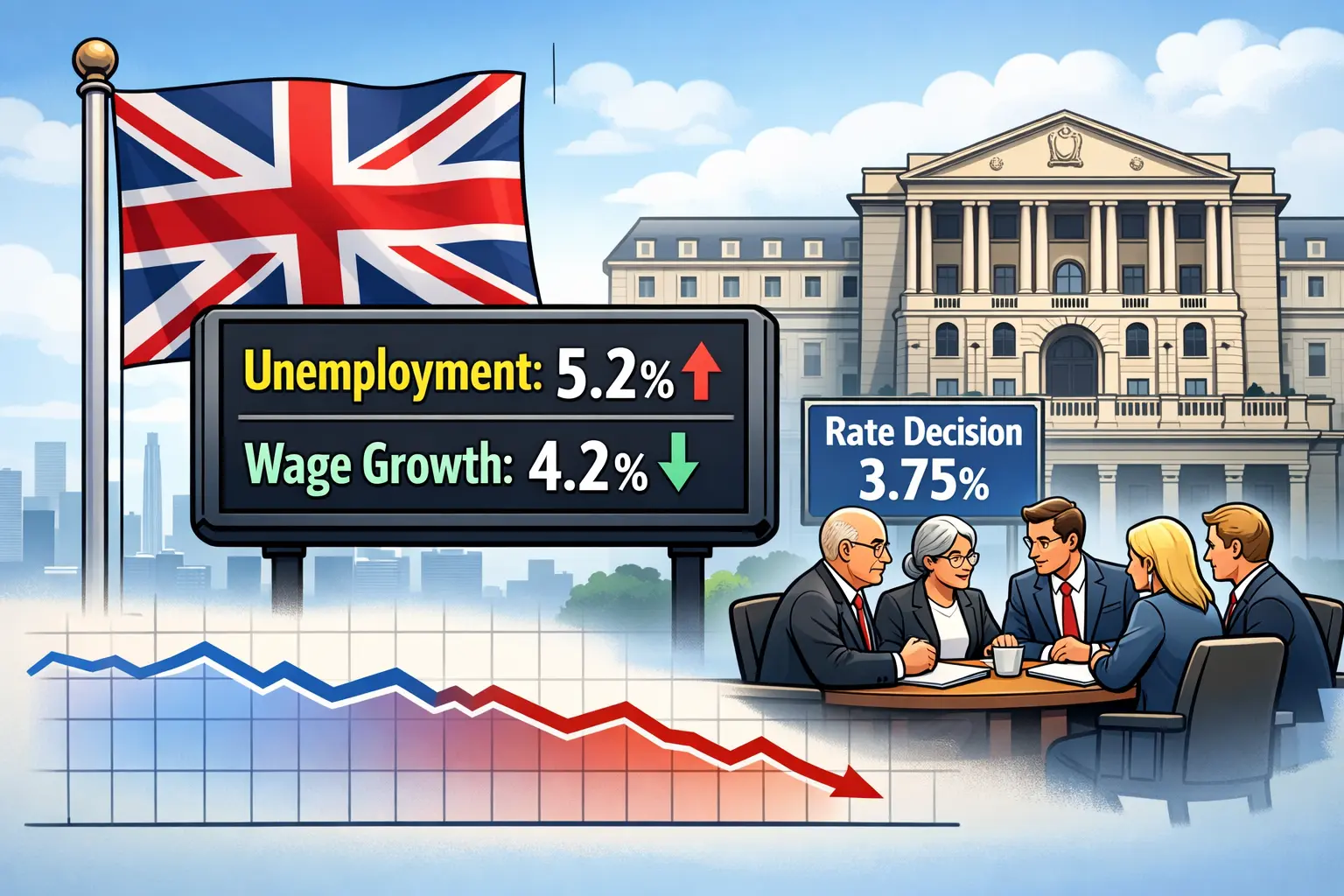

According to data from the Office for National Statistics, the unemployment rate rose to 5.2% in the three months to December, up from 5.1% previously and marking the highest level since early 2021. The steady upward drift in joblessness underscores mounting pressure in the labour market after a prolonged period of tight conditions.

Wage Growth Moderates, Easing Inflation Concerns

At the same time, wage growth showed clearer signs of cooling. Average earnings excluding bonuses slowed to 4.2% year-on-year, down from 4.5% in the prior reading. The moderation in pay growth suggests that labour-market tightness is gradually easing, reducing the risk of sustained wage-driven inflation pressures.

For policymakers, the combination of rising unemployment and slower wage growth could provide reassurance that underlying inflationary forces are diminishing. The Bank of England has closely monitored wage data as a key gauge of persistent inflation risks, making this latest slowdown particularly significant for the policy outlook.

Bank of England Policy: A Divided Committee

At its February meeting, the Bank of England left the Bank Rate unchanged at 3.75%, but the decision revealed continued divisions within the Monetary Policy Committee. The vote passed narrowly, 5–4, marking the third consecutive meeting with a closely split outcome.

The tight vote reflects ongoing debate over how quickly to adjust policy as inflation eases but economic growth remains fragile. While some members favor maintaining a cautious approach, others appear increasingly concerned that restrictive policy could exacerbate labour-market weakness.

Rate Cut Expectations Strengthen

Economists argue that the latest employment and wage figures strengthen the case for further easing. Analysts at Capital Economics noted that the lack of meaningful improvement in labour-market conditions, combined with softer wage pressures, supports expectations for at least two additional rate cuts this year.

They also suggested that the probability of the next cut coming as early as March, rather than April, has increased following the latest data. Market pricing has gradually shifted in that direction, with investors weighing the risk that delaying cuts could deepen economic softness.

What Markets Are Watching Next

- Upcoming inflation data to assess whether price pressures continue to ease

- Further labour-market releases for confirmation of sustained cooling

- Bank of England commentary ahead of the next policy meeting

- Broader UK economic indicators, including retail sales and GDP growth

Outlook: Gradual Easing Path Emerging

Looking ahead, the trajectory of the UK labour market will be central to the Bank of England’s next move. If unemployment continues to rise and wage growth softens further, the case for near-term rate cuts will strengthen. However, policymakers remain mindful of inflation risks and are likely to proceed cautiously, particularly given the recent pattern of closely divided votes.

For now, the data point to a gradual easing of labour-market pressures, increasing the likelihood that the Bank of England will begin to lower borrowing costs in the near future.

Summary

The UK unemployment rate climbed to 5.2% in December, its highest level since 2021, while wage growth slowed to 4.2%, signaling continued softening in the labour market. The data reinforce expectations of additional Bank of England rate cuts, potentially as early as March. With policymakers divided and economic conditions cooling, the path toward gradual monetary easing appears increasingly likely.

FAQs

Why did the UK unemployment rate increase?

The rise reflects ongoing softening in the labour market as hiring momentum slows and economic growth remains moderate.

Why is wage growth important for the Bank of England?

Strong wage growth can fuel persistent inflation. Slower wage increases reduce pressure on policymakers to keep rates high.

What is the current Bank of England rate?

The Bank Rate currently stands at 3.75% following the February meeting.

When could the next rate cut occur?

Market expectations suggest a possible rate cut as early as March, though April remains a strong possibility.

How do these labour market trends affect the UK economy?

A cooling labour market may ease inflation pressures but could also signal slower economic momentum ahead.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or economic advice. Economic conditions and market expectations can change rapidly. Readers should conduct their own research or consult a qualified professional before making financial decisions.