Forex Markets Cautious Ahead of US CPI; Dollar Direction to Set Near-Term Bias

Headlines & Market Snapshot

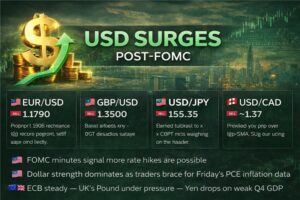

Major currency pairs are trading in tight ranges as investors await the latest US Consumer Price Index (CPI) data, a release that could reshape expectations for the Federal Reserve’s policy path. The US Dollar remains the dominant driver across FX markets, with rate-cut projections, inflation trends, and central bank divergence dictating short-term positioning. While the broader tone is cautious, underlying technical structures in several pairs continue to favor trend continuation rather than aggressive reversals.

Market Overview

The Federal Reserve’s recent decision to keep rates steady has shifted attention squarely toward incoming inflation data. With markets already pricing in multiple rate cuts into 2026, any upside inflation surprise could quickly unwind those expectations and strengthen the Dollar. Conversely, softer inflation would likely reinforce dovish bets and pressure USD pairs.

In Europe, economic momentum remains moderate, limiting aggressive upside in EUR crosses. In the UK, political stabilization has reduced near-term risk premiums, though soft macro data continues to weigh on rate expectations. Meanwhile, in Japan, normalization expectations from the Bank of Japan contrast with still-elevated US yields, keeping USD/JPY volatile. Australia’s inflation resilience and hawkish undertones from the Reserve Bank of Australia provide relative support to AUD.

Overall, this is not a breakout market — it’s a positioning market. Traders are reacting, not leading.

Technical Summary (Indicative — Update With Live Data Before Publishing)

| Pair | Trend Bias | RSI Zone | MA Structure | Key Resistance | Key Support | Trade Bias |

|---|---|---|---|---|---|---|

| EUR/USD | Bullish | 54–56 (Buy Zone) | All MAs in positive crossover | 1.2030 / 1.2150 | 1.1640 / 1.1520 | Buy dips |

| GBP/USD | Mild Bullish | 51 (Neutral-Bullish) | Short-term MAs bearish, 50 MA bullish | 1.3832 / 1.3956 | 1.3432 / 1.3308 | Buy near support |

| USD/JPY | Bearish | 38 (Sell Zone) | All MAs negative crossover | 158.24 / 159.98 | 152.62 / 150.88 | Sell rallies |

| AUD/USD | Bullish | 63 (Buy Zone) | Strong positive crossover | 0.7071 / 0.7173 | 0.6742 / 0.6640 | Buy pullbacks |

Analyst Commentary

EUR/USD

Momentum remains constructive despite the recent four-session pullback. RSI above 50 confirms buyers still control the broader structure. However, upside progression is likely to be gradual rather than explosive. Without a decisive Dollar breakdown, rallies may stall before resistance clusters above 1.2000.

GBP/USD

Short-term moving averages suggest hesitation, but the broader structure remains supported. The pair is clearly waiting for US CPI for direction. Buying aggressively before the data release is premature — better entries lie near defined support rather than mid-range levels.

USD/JPY

Technically the cleanest setup among the four. Bearish moving average alignment and RSI in sell territory reinforce downside bias. Any recovery toward the 155 area looks corrective unless inflation surprises materially lift US yields.

AUD/USD

Strongest technical profile currently. Positive MA alignment and RSI strength confirm bullish structure. However, stochastic readings indicate near-term overextension, meaning chasing highs is risky. Pullbacks toward 0.7000 offer better risk-reward.

AI Q&A

Q: What is the most important catalyst today?

US CPI. It directly impacts Fed rate expectations and therefore Dollar direction.

Q: Which pair has the strongest technical structure?

AUD/USD on the bullish side; USD/JPY on the bearish side.

Q: Is this a breakout environment?

No. It’s a data-driven consolidation phase. Volatility expansion depends on inflation surprise magnitude.

Q: Should traders enter before CPI?

Only with defined risk. Pre-data positioning without tight stops is gambling, not trading.

Key Takeaways

- US CPI is the primary short-term driver across FX.

- EUR/USD and AUD/USD retain bullish structures but need Dollar weakness for extension.

- GBP/USD remains range-bound with mixed signals.

- USD/JPY shows sustained bearish technical alignment.

- Patience matters more than prediction in event-driven markets.

If inflation surprises, positioning will shift fast. If it doesn’t, expect continuation of controlled, technically-driven moves rather than sharp directional breakouts.