US Dollar Index Slips Below 98.00 on Dovish Fed Bets.

US Dollar Index Slips Below 98.00 as Cooling Jobs Data Reinforce Dovish Fed Bets

Market Overview: Dollar Pauses After Brief Rally

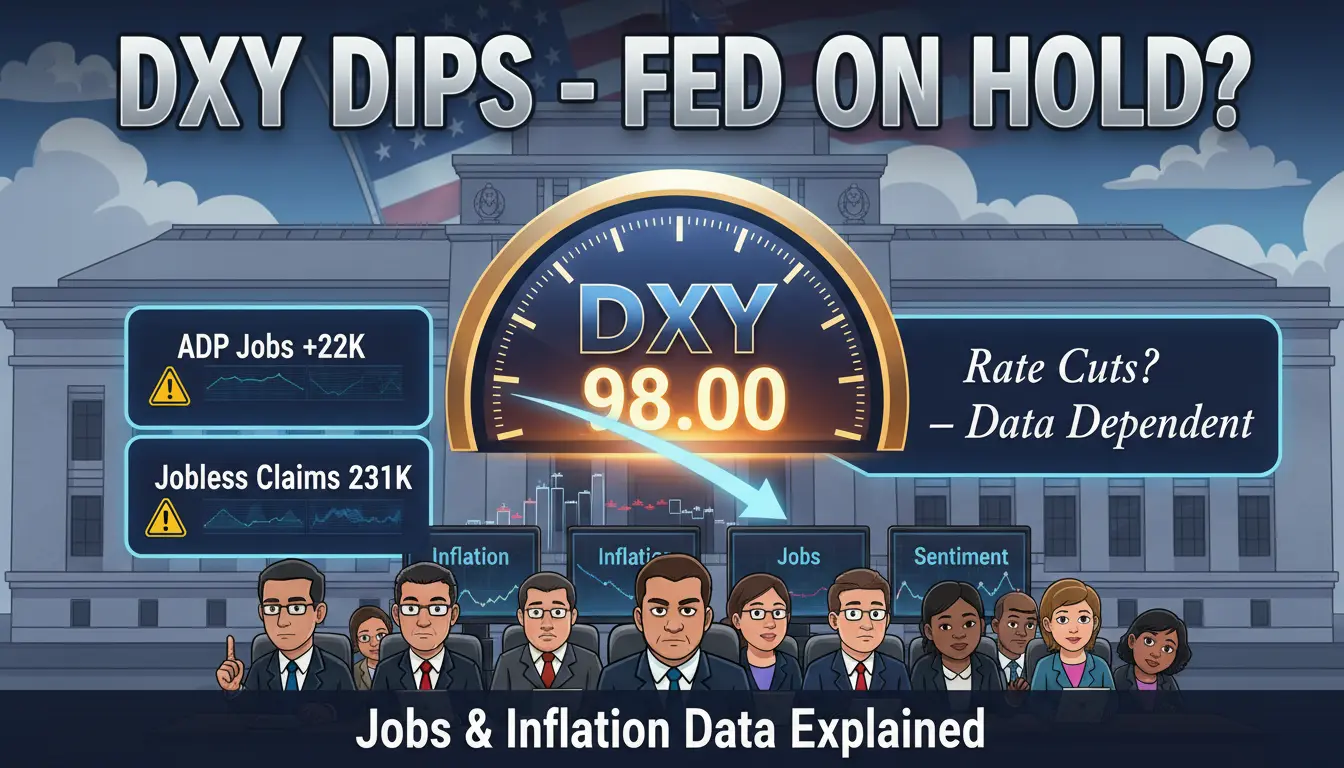

The US Dollar Index (DXY) edged lower on Friday, slipping below the 98.00 handle after two consecutive sessions of gains. During European trading hours, the index hovered near 97.90, as investors reassessed the outlook for US monetary policy following softer labor market signals. Attention now turns to the preliminary February Michigan Consumer Sentiment Index, due later in the North American session, which could influence near-term dollar direction.

The pullback reflects a shift in sentiment rather than a decisive trend reversal, with markets increasingly confident that the Federal Reserve is moving closer to policy easing.

Labor Market Signals Fuel Dovish Expectations

Recent US labor data have strengthened expectations that the Fed may adopt a more dovish stance in the months ahead. Initial Jobless Claims rose to 231,000 for the week ending January 31, well above market forecasts of 212,000 and higher than the previous 209,000 reading. The increase added to evidence that labor market conditions may be cooling after a prolonged period of resilience.

At the same time, the latest ADP employment report showed private-sector job growth slowing sharply to 22,000 in January, a significant miss versus expectations and a clear step down from the prior month’s revised figure. Together, these releases have reinforced the view that hiring momentum is losing steam, increasing the likelihood of Fed rate cuts later this year.

Fed Outlook: Markets Price Cuts, Policymakers Urge Patience

Markets are currently pricing in two interest rate cuts in 2026, with the first expected as early as June, followed by a potential move in September. Futures pricing suggests roughly a 77% probability that the Fed will keep rates unchanged at its March meeting, underscoring expectations that policymakers will wait for additional confirmation before acting.

Despite the softer data, Fed officials continue to strike a cautious tone. Fed Governor Lisa Cook recently emphasized that she would not support further easing without clearer evidence that inflation is sustainably moderating. She noted greater concern about stalled disinflation than labor market softness, suggesting the bar for rate cuts remains relatively high.

Political Developments Offer Limited Support

The dollar has found some underlying support from political developments surrounding the Federal Reserve. Markets continue to assess the implications of Kevin Warsh’s nomination as Fed Chair, with his preference for a smaller balance sheet and a more cautious approach to rate cuts helping to ease concerns about the Fed’s policy credibility and independence.

While the nomination has not reversed the broader bearish pressures tied to rate cut expectations, it has helped limit downside moves in the Dollar Index.

What Traders Are Watching Next

- The Michigan Consumer Sentiment Index for signals on household confidence and spending

- Upcoming US inflation data for confirmation of disinflation trends

- Additional labor market releases ahead of the official nonfarm payrolls report

- Fed commentary for clarity on the timing and pace of potential rate cuts

- Treasury yield movements and broader risk sentiment

Outlook: Dollar Faces Headwinds, But Losses May Be Gradual

Looking ahead, the US Dollar Index remains vulnerable to further downside if incoming data continue to point toward labor market cooling and easing inflation pressures. However, expectations that any Fed rate cuts will be gradual — combined with policymakers’ cautious rhetoric — suggest that dollar weakness may unfold in a measured rather than abrupt fashion.

As long as inflation concerns persist and growth remains broadly stable, the greenback is likely to trade within a volatile but contained range, reacting closely to each new data release.

Summary

The US Dollar Index slipped below 98.00 as weaker labor market data strengthened expectations of a more dovish Federal Reserve. Rising jobless claims and a sharp slowdown in private-sector hiring have shifted market focus toward potential rate cuts beginning mid-year. While Fed officials continue to emphasize patience and inflation risks, the balance of data has tilted sentiment against the dollar, keeping it under pressure despite recent gains.

FAQs

What is the US Dollar Index (DXY)?

The US Dollar Index measures the value of the US dollar against a basket of six major currencies, including the euro and the yen.

Why did the dollar weaken despite recent gains?

Softer US labor market data increased expectations of Fed rate cuts, reducing support for the dollar.

When are markets expecting the first Fed rate cut?

Markets are currently pricing in the first rate cut around June, with a possible second cut later in the year.

How important are jobless claims for the dollar?

Rising jobless claims can signal labor market cooling, which may pressure the dollar by increasing expectations of easier monetary policy.

Could the dollar recover in the near term?

Yes, stronger inflation data or more hawkish Fed commentary could provide temporary support, even if the broader trend remains cautious.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Market conditions and economic data can change rapidly, and past performance is not indicative of future results. Readers should conduct their own research or consult a qualified professional before making investment decisions.