USD/CHF Nears 0.7950 as Dollar Stabilizes Ahead of US Data.

USD/CHF Nears 0.7950 as Dollar Stabilizes Ahead of Michigan Sentiment Data

What’s Happening

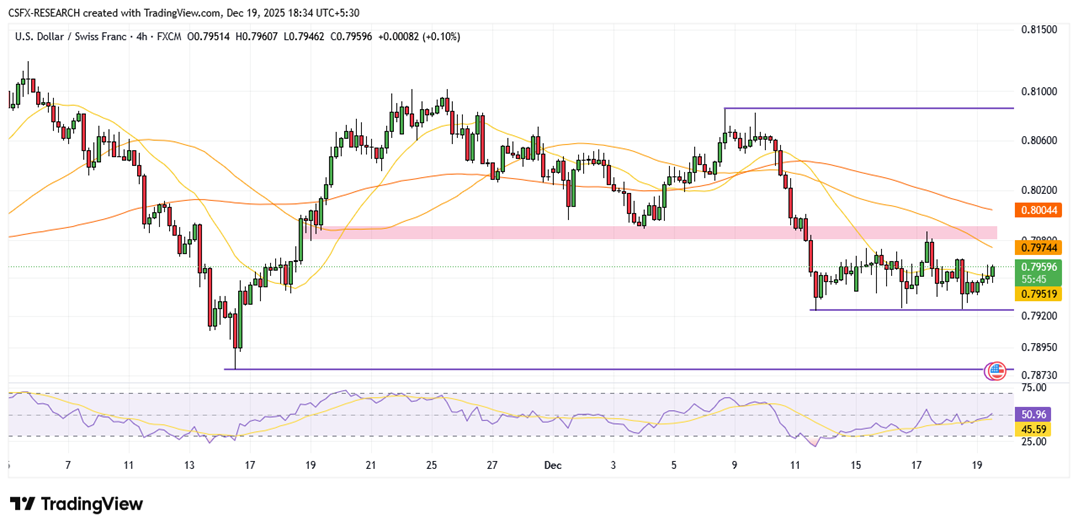

USD/CHF is trading firmer near the 0.7950 area during the European session, recovering from the previous day’s losses as the US dollar steadies. Market participants remain cautious ahead of the University of Michigan Consumer Sentiment Index, which could influence short-term USD direction.

Market Overview (Fundamental Analysis)

The US dollar has found mild support ahead of key US data, though broader upside remains limited. Recent softer-than-expected US inflation figures have reinforced expectations that the Federal Reserve may deliver further rate cuts in the future, keeping the greenback under pressure.

Political headlines are also in focus after comments from US President Donald Trump indicating that the next Federal Reserve chair is likely to favor significantly lower interest rates. This has added to market speculation around a more accommodative Fed stance beyond current leadership.

From Switzerland, trade data showed the trade surplus widening to CHF 3.84 billion, supported by rising exports and lower imports. While this underscores resilience in external balances, investors continue to evaluate the Swiss National Bank’s policy outlook, with negative rates still viewed as unlikely due to their impact on savers and pension funds.

Technical Snapshot (Daily / Short-Term Overview)

| Indicator | Reading / Value | Implication |

|---|---|---|

| Trend | Downtrend | Broader bearish structure intact |

| General Bias | Neutral to Bearish | Recovery lacks conviction |

| Key Resistance | 0.7992 | Near-term ceiling |

| Key Support | 0.7926 | Short-term floor |

| RSI (14) | 56 | Mild bullish momentum |

| MACD | Neutral | Weak directional signal |

| Moving Averages | Below 50 & 100 SMA | Downside trend pressure |

Technical Summary:

USD/CHF remains within a broader downward channel and continues to trade below key moving averages. While momentum indicators show some stabilization, price action near resistance suggests limited upside unless a clear breakout develops.

Trade Idea (Setup Section)

Trade Type: Limit Sell

Entry Level: 0.7988

Take Profit: 0.7924

Stop Loss: 0.8028

Rationale: Price is approaching resistance within a broader downtrend, where previous recovery attempts have failed.

Alternate Scenario:

A sustained break above 0.8030 could invalidate the bearish setup and open the door toward the 0.8080 area.

What to Watch Next (Forward Outlook)

• University of Michigan Consumer Sentiment Index

• Ongoing reassessment of Federal Reserve rate expectations

• US political developments affecting monetary policy outlook

• Swiss National Bank commentary or policy signals

• Broader risk sentiment influencing CHF demand

Key Takeaway

USD/CHF is attempting to recover toward 0.7950, but the broader technical structure remains bearish. As long as the pair stays below the 0.7990–0.8000 resistance zone, downside risks are likely to persist.

Q&A (SEO-Optimized Section)

What is the current USD/CHF analysis today?

USD/CHF is trading near 0.7950, supported by a modest US dollar rebound ahead of key sentiment data, though broader downside risks remain.

What is the near-term USD/CHF forecast?

The near-term outlook remains cautious, with rallies potentially capped below 0.8000 unless US data significantly strengthens the dollar.

What does the USD/CHF technical outlook suggest?

The technical outlook points to a prevailing downtrend, with price below key moving averages and resistance limiting recovery attempts.

Disclaimer: This market analysis is provided for informational purposes only and does not constitute investment or trading advice.